CFC Regulation in Taiwan – Individual

The purpose of Controlled Foreign Company (Hereafter referred to as CFC) regulation is to avoid profit-seeking enterprise, which established its company in low-tax rate burden country (Profit-seeking enterprises income tax rate less than 14%, like BVI; or only pay the domestic income tax, like Hong Kong or Singapore)without any practical business activity via CFC, evading the tax payable with the practical control or shares to get away with the policy of surplus distribution of the company in Taiwan. Therefore, the policy to curb tax evasion promulgated at the article 43-3 in Income Tax Act was established officially on 27/07/2016 to balance the entire regulation of taxation.

With the upcoming deadline of special law of repatriated fund within the last two years till now (the law will be expired on August.), CFC regulation is about to come on the heels of it in 2020 by the arrangement of Ministry of Finance in Taiwan. Hundreds of businessmen in Taiwan who preferred to register their companies in BVI or Cayman Islands and invested firms in other countries is going to face an influential effect shortly.

For individual, individual and spouse or kins in the second degree of relationship who holds the shares or capital of CFC more than 10%, it is required to calculate the surplus with the direct rate of shareholdings of CFC at that year into the oversea earnings of AMT (Alternative Minimum Tax). In contrast, CFC which meets the one of the following requirements can be exempted from the abovementioned regulation:

- The location of country or area of CFC with “practical business activities”.

- The amount of surplus earnings from one individual CFC is under NT$7,000,000, but if the total amount of earnings with losses from such CFC is more than NT$7,000,000, the CFC still have to comply with CFC regulation to pay taxes.

For instance, Company A is established in the low-tax burden rate burden country. C (individual) holds the shares directly of Company A 9 % (under 10%); the spouse of C (Here is called D) holds the shares directly of Company A 9% (under 10% as well). However, in the circumstance of the total amount of direct shareholdings with C and D more than 18% (Over 10%), C will be imposed taxes under CFC mandatorily.

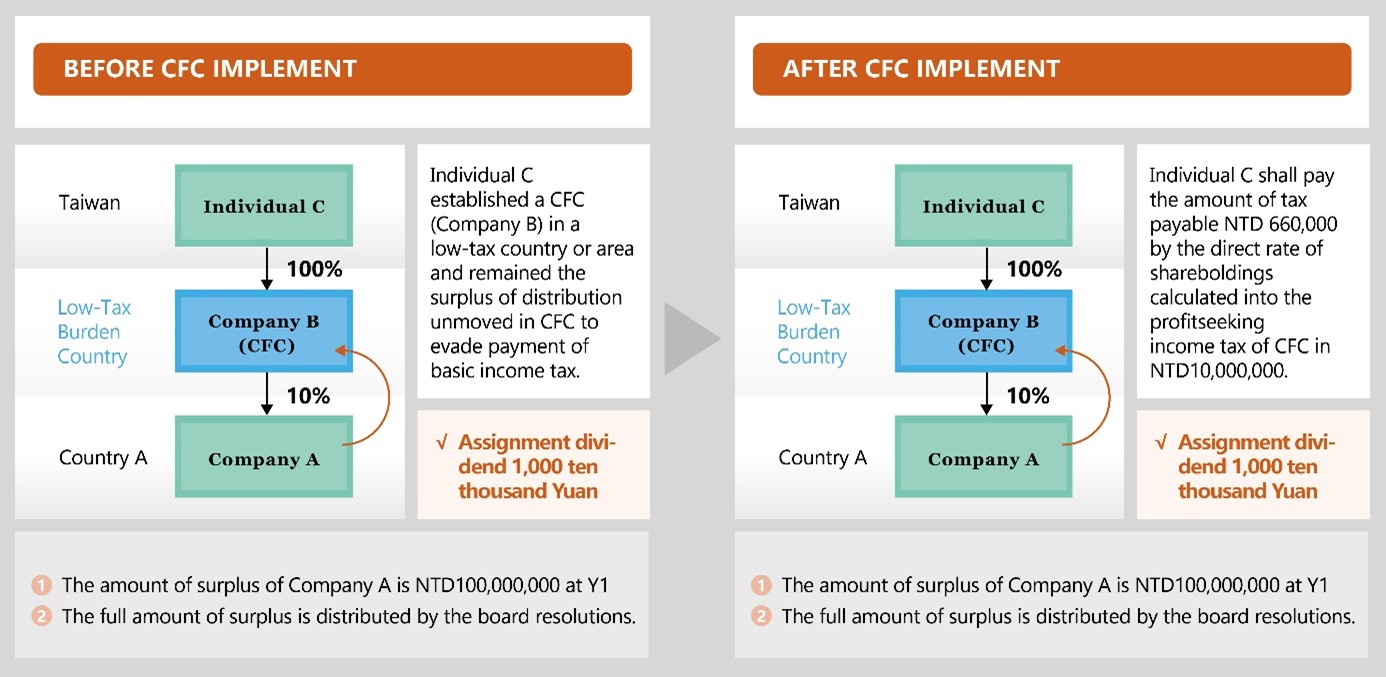

The comparison of before-and-after implementation as following:

Under AMT, the amount of exemption is NTD6,700,000 for one household, the rate of taxation in 20%.

For individual with CFC, the following required document is required to be submitted in declaration of tax return:

- The structure of the individual and the related person, the number of shareholdings, capital, and rate of shareholdings.

- A financial statement certificated by a certified accountant in the designated country or republic of China. If other documents certified by the local competent authorities can prove the authenticity of the financial statement, such documents are able to be the substitute of the certificated financial statement by certified accountant.

- Loss carryforwards statement prior 10 years before the date of CFC establishment.

- Recognized CFC investment profit statement

- Certificate of tax payment issued by the foreign ROC competent authority, or the authorities recognized by ROC government for those who converted into CFC and applied to the oversea rules of tax offset.

- Shareholder agreement or minutes of board of shareholders of converted CFC.

- Certificate of loss recovery, consolidation, bankruptcy, or liquidation promulgated by ROC embassies or other authorities recognized by ROC government.

For those who refused the investigation from related competent officers or to provide them with the related information of taxation, the said persons will face the punishment of fine more than NTD3,000 but less than NTD30,000; For who failed to declare the basic income tax, the said persons will not only be required to restore the overdue taxes but be fined the three times of overdue taxes. (Those who declare the false amount of basic income will be fined the two times of taxes payable.)

In spite of the hardness of full understanding of the information of foreign companies, it is accessible to report to Investment Commission of Ministry of Economic Affairs (MOEAIC) for inspection of foreign investment. Moreover, with the CRS network of information exchange and report of anti-money laundering, the information of foreign invested companies become more and more clear. According to the revised draft in Tax Collection Act, the original article of “A taxpayer who evades tax payment by fraud or other unrighteous shall be sentenced to imprisonment for no more than five 5 years, detention, or in lieu thereof or in addition thereto, be imposed with a fine of no more than NT$60,000” is revised into “The imprisonment for no more than five 5 years, detention, or in lieu thereof or in addition thereto, be imposed with a fine of no more than NT$5,000,000.”. Besides, Taxpayers who evade the responsibility to pay the amount of tax payables more than NTD10,000,000 shall be sentenced to imprisonment for no more than five 5 years, detention, or in lieu thereof or in addition thereto, be imposed with a fine of more than NT$10,000,000 but less than NTD100,000,000. The purpose of abovementioned punishment is to urged taxpayers to comply with the CFC regulation to pay taxes honestly.