Introduction and Issuance of Uniform Invoice (Part I)

The purpose of this article is to introduce Taiwan uniform invoice and instruct how to issue.

The introductions as below:

- Category of uniform invoice

- Principle of issuance

- How to issue a handwritten invoice

- How to deal with the wrong uniform invoice

The article is divided into two parts for readers’ convenience to understand.

- Category of uniform invoice

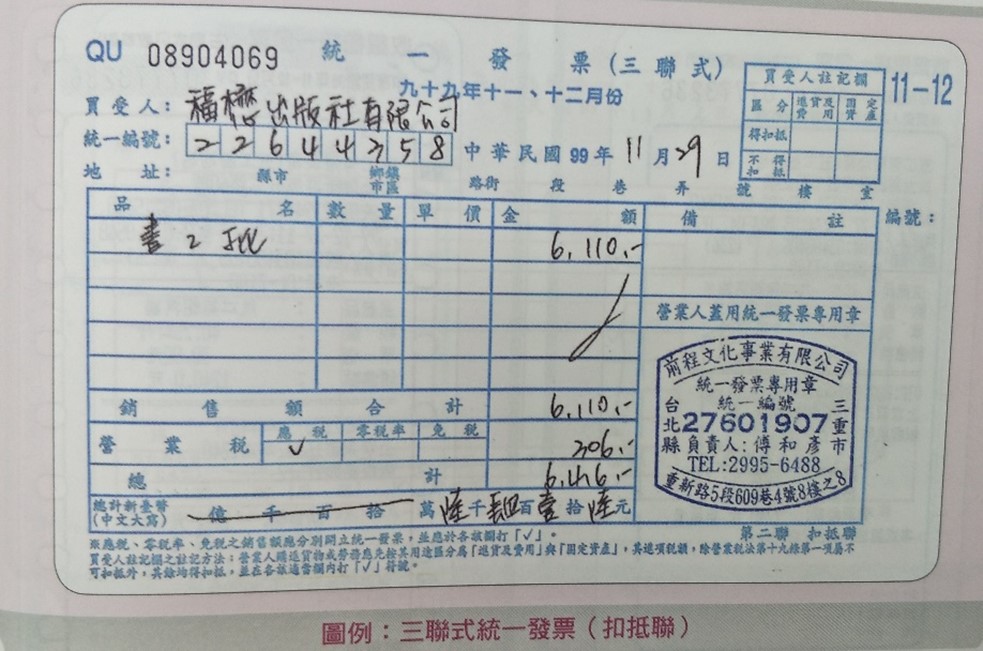

(1) Triplicate Uniform Invoice: A business entity issues this type of invoice to another business entity (B to B).

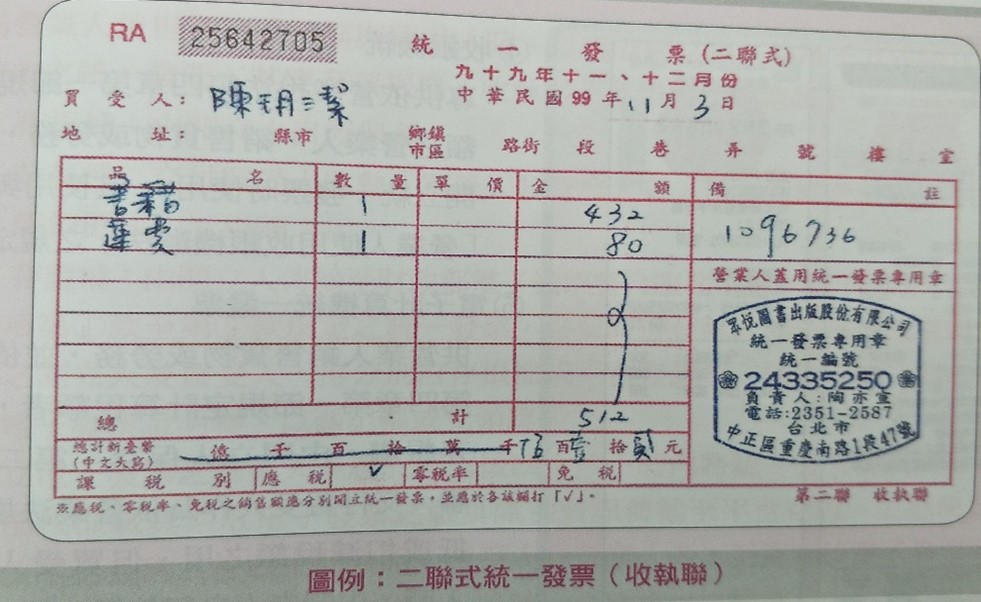

(2) Duplicate Uniform Invoice: A business entity issues this type of invoice to a customer (B to C).

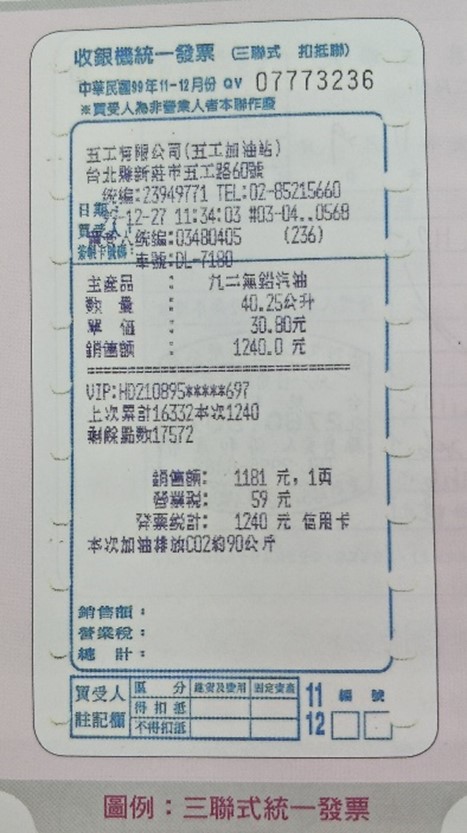

(3) Cashier Invoice: A business entity issues this type of invoice to a purchaser (including business entities (B to B) and customers (B to C)), or it can be divided into triplicate form (stub copy, receipt copy, and deduction copy) and duplicate form (stub copy and receipt copy) for the sake of bookkeeping. 3-1. Cashier Invoice in triplicate from

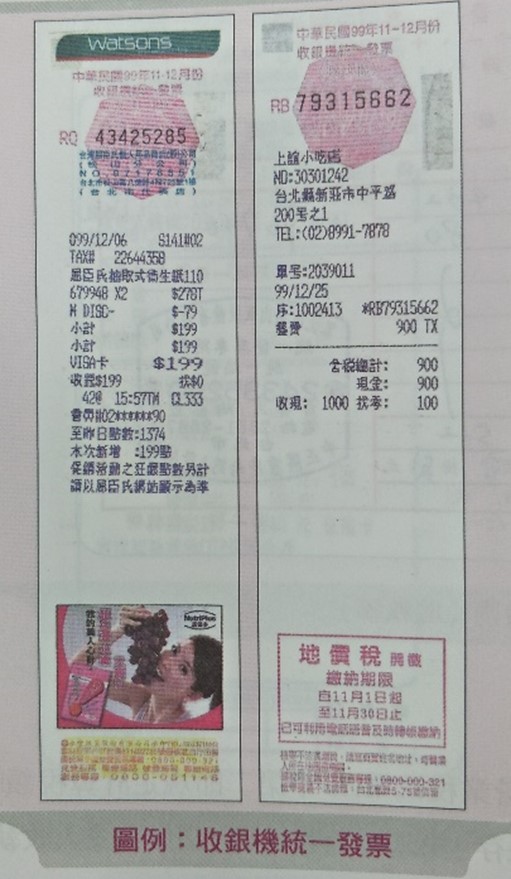

3-2 Cashier invoice in duplicate form

(4) Electronic Invoice: A business entity issues this type of invoice to a purchaser (including business entities (B to B) and customers (B to C))

- Principle of Issuance

It is unchangeable for a copy of issued uniform invoice. For example, it is not allowed to reissue the uniform invoice in June with the uniform invoice in July to August, but if the volume of uniform invoice within this term are run out, it is possible to send a notice to a public accountant firm to issue the uniform invoice on the next term. That is, the whole volume of uniform invoice is run out on 30th June, but the volume of uniform invoice in July is purchased, it is possible to issue a uniform invoice on the next term from July to August.

It should be noted that the uniform invoices shall be issued in serial number. It is not suggested to issue the uniform invoice randomly since it may omit to file completely and be imposed with the fine of sales income. The condition is usually occurred form Taiwan company requests to issue a uniform invoice at the end of month or the next month. If it has no choice but issue a uniform invoice without following the serial number, it is suggested to give the accounting colleagues or firms this insight, put a memo on the invoice, write this condition on the cover of invoice brochure to remind the existence of such invoice.

The best way to deal with the errors on the uniform invoice is to annul and reissue it. Putting the symbol “X” or word “Annulled” on the invoice and annulling the invoice with the wrong amount are the common ways to deal with the wrong ones. In the condition of necessary revision on the invoice, it is mandatory to stamp the responsible person’s chop on each revised place apart from the amount and the revision is only allowed to be made on the same invoice. This method is convenient but illegal. Despite of no any case of punishment occurred currently, it is still be contemplated the risk of it. The detailed conditions can be referred to the article 48th in Business Tax Act:

(1) In the event a business entity fails to record the necessary particulars or records false data on issuing uniform invoices, in addition to being ordered to make corrections or fulfill the requirements within a specified time limit, the business entity shall be fined an administrative fine of 1% of the sales amount on the uniform invoice, but in an amount of no less than NT$1,500 and no more than NT$15,000. In case the business entity fails to make corrections or fulfill the requirements after being notified or fails to make appropriate corrections or fulfill the appropriate requirements, the penalty shall be imposed consecutively for each violation according to the relevant laws and regulations. (2) In case the aforementioned unrecorded or false recorded item on the uniform invoice is the name, address, or business administration number of the purchaser, the second and the subsequent punishment shall be 2% of the sales amount stated on the invoice and shall be no less than NT$3,000 and no more than NT$30,000.