Requirements for Registers of Registrable Controllers of Singapore Company

Overview

The Singapore Companies Act (Cap. 50) (“Companies Act”) has been amended to introduce register of registrable controllers (“RRC”) of companies under the new Part XIA which came into effect on 31 March 2017. These amendments are accompanied by a new set of subsidiary legislation – the Companies (Register of Controllers and Nominee Directors) Regulations 2017 which also took effect on 31 March 2017.

The RRC makes the ownership and control of corporate entities more transparent and reduces opportunities for the misuse of corporate entities for illicit purposes. This will bring Singapore in line with international standards, and boost Singapore’s on-going efforts to maintain a strong reputation as a trusted and clean financial hub.

Unless exempted, all Singapore locally registered companies are required to take reasonable steps to identify the persons who have significant control over the company and maintain beneficial ownership information in the form of a RRC. The companies should make the RRC available to the officer from Accounting and Corporate Regulatory Authority of Singapore (“ACRA”) and other public agencies, upon request.

To help companies prepare to comply with this new requirement, existing companies will be given a transitional period of 60 days from the date of commencement of the new law (i.e. 31 March 2017) to set up the RRC, after which they must have and continue to maintain the required RRC. Companies incorporated on or after 31 March 2017 will have a transitional period of 30 days to set up the RRC.

- Who Qualifies as a “Controller” of a Company?

A Controller is defined as an individual or a legal entity fulling at least one of the following conditions:

- The person holds, directly or indirectly, more than 25% of the shares in a company with share capital;

- The person holds, directly or indirectly, more than 25% of the total voting power in a company with share capital;

- The person holds, directly or indirectly, more than 25% of the capital or profits of a company without share capital;

- The person holds, directly or indirectly, the right to appoint or remove directors who hold most voting rights at meetings of the directors;

- The person holds, directly or indirectly, more than 25% of the rights to vote on those matters that are to be decided upon by the members of the company; and

- The person has the right to exercise or exercise significant influence or control over the company.

An individual controller is an individual who has a significant interest in, or significant control over, the company. While, a corporate controller is a legal entity which has a significant interest in, or significant control over, the company.

- How to Set up and Maintain the RRC?

Companies are required to take ‘reasonable steps’ to find out and identify their controllers and obtain information on the controllers. The ‘reasonable steps’ means a company must minimally send out a notice to anyone whom they know or have reasonable grounds to believe to be controllers and anyone who know the identity of the controllers or is likely to have that knowledge annually.

Companies may send the notice electronically or in hardcopy format and this task can be undertaken by the company secretary. The notices do not have to be signed by a company director or secretary of the company before being sent out.

Companies are required to enter or update particulars of registrable controllers into their RRC within two (2) business days after the have been confirmed. If the particulars of a registrable controller are not confirmed, a company must enter or update the that the company has in its possession into register with a note indicating that the particulars have not been confirmed by the registrable controller.

The RRC is to be kept at the company’s registered office or the registered office of the registered filing agent appointed by the company for the purpose of keeping the RRC. The registers must be made available to the ACRA and public agencies administering or enforcing any written law (including Commercial Affairs Department of Singapore Police Force, Corrupt Practices Investigation Bureau and Inland Revenue Authority of Singapore).

Companies must not disclose or make available for inspection the RRC or any contained therein to any member of the public. Auditors are also not entitled to have access to the register.

- What Information Needs to be Maintained in the RRC?

For Registrable Individual Controllers

- Full name;

- Aliases; if any

- Residential address;

- Nationality;

- Identification card number or passport number;

- Date of birth;

- Date on which the registrable individual controller became an individual controller of the company; and

- Date on which the registrable individual controller ceased to be an individual controller of the company; if applicable

For Registrable Corporate Controllers

- Name;

- Unique Entity Number issued by the ACRA; if any;

- Address of registered office;

- Legal form of the registrable corporate controller;

- Jurisdiction where, and statute under which, the registrable corporate controller is formed or incorporated;

- Name of the corporate entity register of the jurisdiction where the registrable corporate controller is formed or incorporated, if applicable;

- Identification number or registration number of the registrable corporate controller on the corporate entity register of the jurisdiction where the registrable corporate controller is formed or incorporated, if applicable;

- Date on which the registrable corporate controller became a corporate controller of the company; and

- Date on which the registrable corporate controller ceased to be a corporate controller of the company, if applicable.

For a Person Receiving a Notice from a Company

- His particulars if he is a controller; and

- Any information that he is aware of about controllers.

- Which Entities are Exempted from Having to Set up an RRC?

The following locally incorporated companies are exempted:

(1)A public company which shares are listed for quotation on an approved exchange in Singapore;

(2)A company that is a Singapore financial institution;

(3)A company that is wholly owned by the Government of Singapore;

(4)A company that is wholly owned by a statutory body established by or under a Public Act for a public purpose;

(5)A company that is wholly owned subsidiary of a company mentioned in (1), (2), (3) or (4);

(6)A company which shares are listed on a securities exchange in a country or territory outside Singapore and which is subject to regulatory disclosure requirements and requirements relating to adequate transparency in respect of its beneficial owners, imposed through stock exchange rules, law or other enforceable means.

Companies that are undergoing winding up, receivership, judicial management, or striking off are not exempted, unless they qualify under one of the categories in (1) to (6).

- Who is registrable controller of a company?

- “Registrable” controllers of a company are required to be registered in the company’s RRC.

- A controller (A) of a company (X) is registrable, unless:

- A’ significant interest in or significant control over X is only through one or more controllers (B) of X;

- A is a controller of B (or each B is more than one); and

- B (or each B if more than one) is either:

- A company or foreign company which is required to keep a RRC under the Companies Act;

- A company or foreign company that is exempted from the requirement to keep a RRC under the Fourteenth and Fifteenth Schedules to the Companies Act respectively;

- A corporation which shares are listed for quotation on an approved exchange under the Securities and Futures Act;

- A limited liability partnership (“LLP”) which is required to keep a RRC of LLP under the LLP Act;

- An LLP that is exempted from the requirement to keep a RRC of LLP under the Sixth Schedule to the LLP Act; or

- A trustee of an express trust to which Part VII of the Trustees Act applies.

The criteria in (1), (2) and (3) must be fulfilled before a controller may be considered as not registrable with respect to a company.

The requirement that controllers of a company must be “registrable” before their particulars are captured in the RRC of that company helps avoid duplicative reporting.

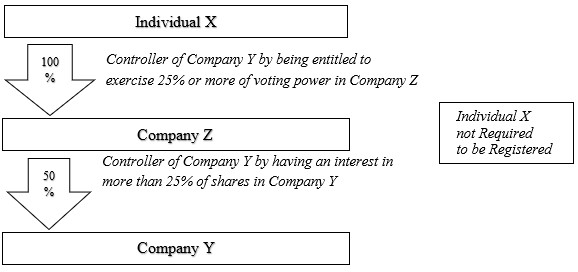

Example 1

If individual X is a controller of a company Y only because he wholly owns company Z which in turn has an interest in 50% of the shares in company Y and company Z is required to keep a RRC, individual X is not a registrable controller which respect to company Y and so individual X’s particulars are not required to be contained in Company Y’s RRC.

Individual X’s particulars would instead be captured in Company Z’s RRC.

Example 2

If individual X is a controller of a company Y not only because he wholly owns company Z which in turn has an interest in 50% of the shares in company Y, but also because he himself has an interest in 5% of the shares in Company Y, then individual X is a registrable controller with respect to company Y and so individual X’s particulars are required to be contained in Company Y’s RRC.

Individual X’s particulars would also be captured in company Z’s RRC.

6. Offences

If a company fails to comply with any of the applicable requirements in relation to the Register of Registrable Controller, the company and every officer of the company who is in default, shall each be guilty of an offence and shall each be liable on conviction to a fine not exceeding S$5,000.00 for each offence.